Fintech / Banking

- Core banking & digital platforms

- Payment gateways & Open API

- BNPL and embedded finance solutions

- …

The entire team is ready: only best analysts, architects, developers, DevOps and QA

We provide documentation and training, that make adoption seamless

Our C-Level are engineers with 15+ years of experience, fluent in the languages of business & architecture

Minimum resources, maximum impact: fast launch, real user feedback and investor attention

Personal manager 24/7, full project support and 6 months beyond release

The client received a fully functional MVP, that demonstrates the entire lending lifecycle - from wallet connection to smart-contract-backed loan issuance. It is now used in demo sessions with potential partners, investors and regulators, while being ready for scaling into a full product.

#BNPL #Fintech #MobileBanking #CreditScoring #API Integration

The system brought together all order and payment processes into a single platform, simplifying financial flow management and increasing transparency. Thanks to its flexible architecture and integration with payment gateways, customers now enjoy convenient payment options, while the accounting team benefits from accurate reconciliations and reporting. Process automation has reduced errors and sped up operations, making the system a reliable foundation for business growth and scaling.

#Billing #Payments #Automation #Accounting #Retail

The new marketplace allowed the client to launch a powerful and user-friendly trading platform, that connects sellers and buyers in one place.Its flexible architecture and scalable design make it ready to grow, expand and handle increasing demand - all while ensuring a smooth user experience and strong security.

#Marketplace #Ecommerce #Logistics #PaymentIntegration #Retail

The hybrid platform successfully launched its own branded card program, enabling secure, compliant fiat transactions across 30+ countries. Users now enjoy seamless payments, while the platform retains full control over the flow - positioning itself as a full-stack crypto-fiat financial service provider.

#Tokenization #Payments #Cards #mobile-pay #Visa #Mastercard

The KYC system, that makes customer verification fast, simple and fully compliant. Users can upload documents and pass biometric checks through an intuitive web or mobile interface. The system uses AI-based OCR and facial recognition and connects to official databases for real-time validation.Bank staff work through a control panel that provides live monitoring, risk alerts and automated compliance reports.

#KYC #Microservices #AML #CFT #OCR #monitoring #onboarding

An automatic document upload and recognition system was implemented, utilizing Optical Character Recognition (OCR) technologies for efficient reading and verification of document data. Biometric authentication tools, including facial recognition to enhance the security level of customer identification.

#Automation #Regulatory Compliance #OCR #Biometric authentication

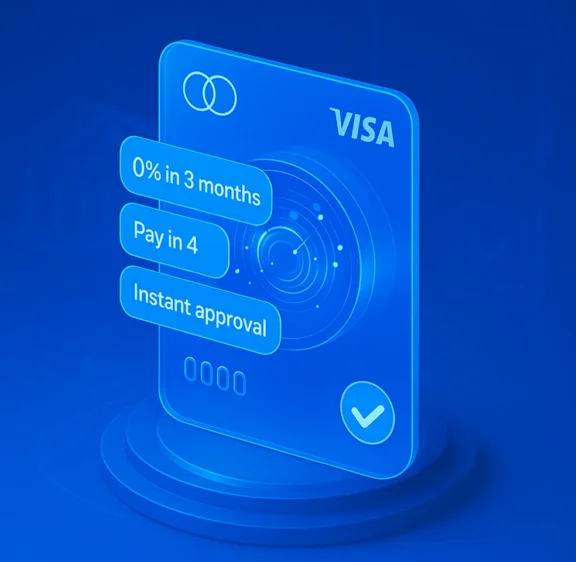

The integrated BNPL system enables instant credit decisions, flexible payments and automated risk management. Clients can access BNPL at partner retailers seamlessly. Bank employees gain tools for portfolio management and risk monitoring, while retailers benefit from easy integration, boosting sales and customer loyalty.

#BNPL #API Integration #CreditScoring #MobileBanking #Fintech

Development

DevOps

QA

Email us and we'll be sure to find a solution that's right for you

Blog

Ekaterina Lobanova

20.01.2026

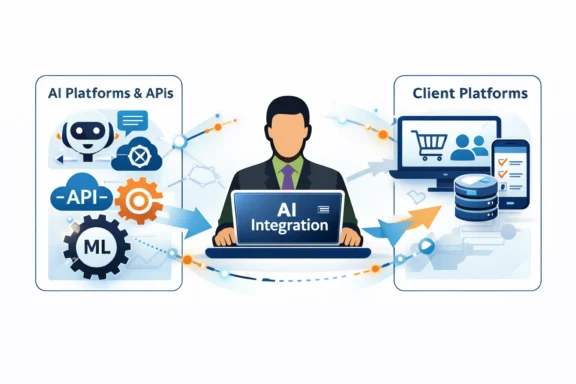

AI development services today are not limited to building models from scratch. For most businesses, the real value of AI lies in correct integration, system development and reliable operation of AI-powered components inside existing digital products. At Intelexity, we focus on ai development as engineering enablement. We help companies adopt and operationalize artificial intelligence by […]

Nika Ananishnova

16.12.2025

A 9-month journey from fragmented payment processes to unified billing automation software – lessons learned in building enterprise-grade invoice processing systems. Modern retail businesses face a persistent challenge: managing financial flows across multiple channels while maintaining accuracy, speed and regulatory compliance. When off-the-shelf billing software for small business can’t keep pace with growth, companies turn […]

Nika Ananishnova

20.10.2025

Modular core banking transormation is reshaping how financial institutions approach IT modernization. It focuses on modernizing the software foundation of core banking systems by decomposing tightly coupled monolithic cores into independently deployable functional modules. In this context, modularity refers strictly to software architecture and core banking platforms, not to hardware infrastructure, processors, storage systems or […]

Nika Ananishnova

22.08.2025 / min read

In today's fast-paced digital landscape, businesses are constantly seeking innovative solutions to enhance efficiency, security, and transparency. The integration of cryptocurrency technologies, particularly blockchain, is proving to be a game-changer for modern business processes.

Nika Ananishnova

22.08.2025 / min read

The world of cryptocurrency and blockchain technology is evolving at a breathtaking pace. At the heart of this revolution lies a commitment to leveraging cutting-edge tools and technologies that enable developers to build faster, more secure, and more innovative solutions.

Nika Ananishnova

22.08.2025 / min read

In the rapidly evolving world of cryptocurrency and blockchain technology, staying ahead of the curve is essential. At our company, we leverage cutting-edge tools and technologies to develop innovative solutions that meet the demands of the modern digital landscape.