Модульная трансформация основных банковских систем меняет подход финансовых учреждений к модернизации ИТ. Она фокусируется на изменении программной основы основных банковских систем путем декомпозиции тесно связанных монолитных ядер на независимо развертываемые функциональные модули.

В данном контексте модульность относится исключительно к программной архитектуре и основным банковским платформам, а не к аппаратной инфраструктуре, процессорам, системам хранения данных или физическим ИТ-компонентам.

Представление о полном демонтаже и замене legacy‑системы – дорогостоящий и чрезвычайно рискованный миф, чаще всего заканчивающийся задержками, перерасходом бюджета и тупиковой ситуацией.

Будущее банковской отрасли – не в одном тяжелом событии, а в постепенном развитии. Шаг за шагом банки могут восстанавливать гибкость архитектуры без колоссальных рисков полного пересоздания системы.

Почему замена основного банковского ядра непрактична

Общеизвестно, что ядра наследованной системы глубоко встроены во все бизнес‑процессы банков. Полная замена – это как делать операцию на открытом сердце марафонцу прямо во время забега. По данным McKinsey, около 70 % банков пересматривают свои ядра платформы из-за их ограничений и снижения скорости изменений. Основные препятствия запредельны:

Длительные перерывы в работе: многолетние проекты, истощающие ресурсы на инновации и ежедневные операции.

Рост бюджета: стоимость стремительно увеличивается из-за непредвиденной сложности и интеграционных барьеров.

Высокий процент неудачи: многие проекты по полной замене ядра не достигают поставленных целей.

Стратегический переход к модульному банковскому ядру

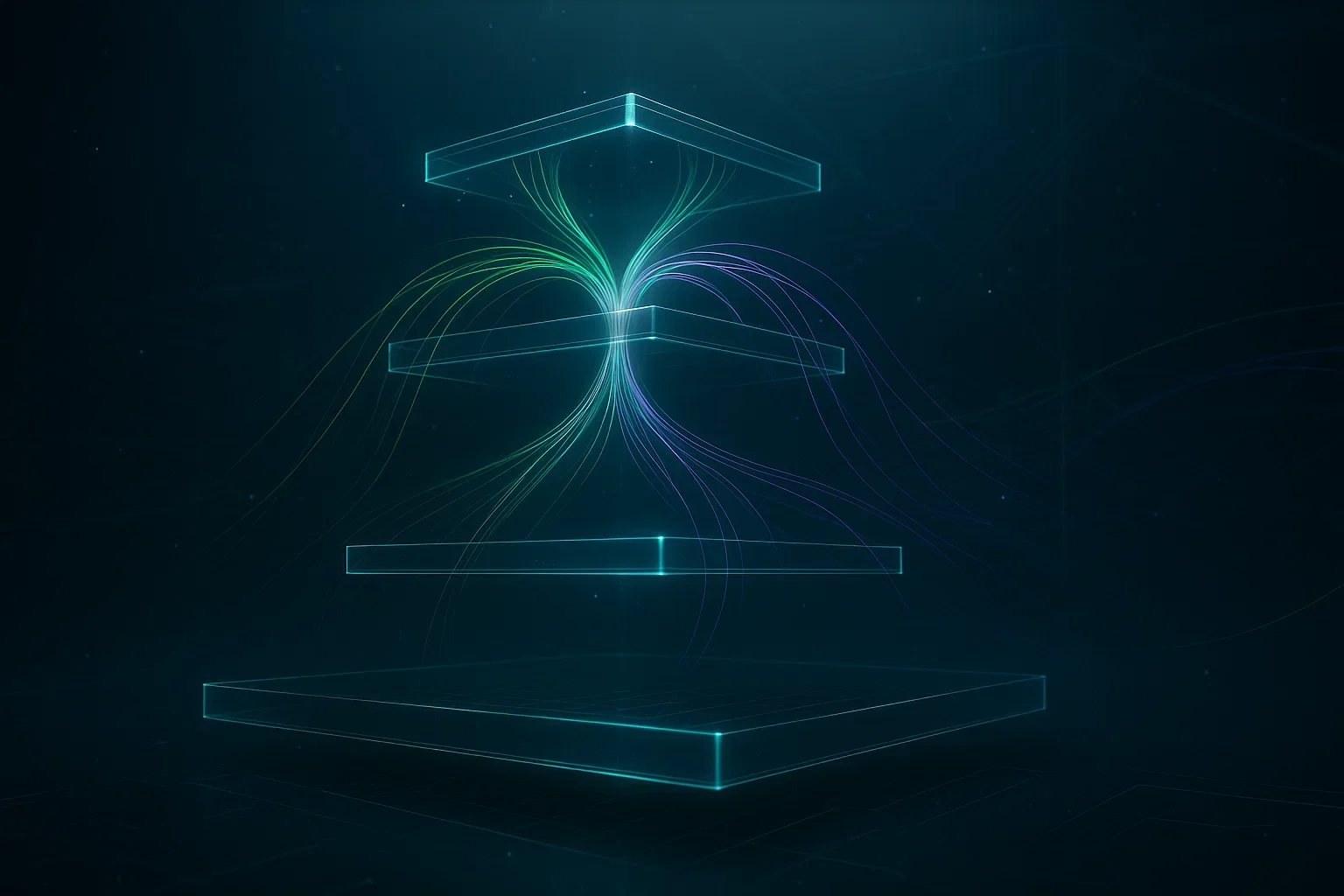

Подход модульного ядра позволяет стратегически разделять и обновлять архитектуру банка по отдельным бизнес‑областям. Вместо установки нового «двигателя» банк постепенно обновляет отдельные «компоненты» – например, трансмиссию или электронику. Этот итеративный жизненный цикл разработки соответствует принципам agile, применяемому в финтех‑разработке.

Как отмечает исследование McKinsey о банках будущего с ИИ, успешная модернизация основывается на шести направлениях: технологическая стратегия, превосходный клиентский опыт, масштабируемая платформы данных, гибридная инфраструктура, настраиваемые продуктовые процессоры и стратегия кибербезопасности.

Эта методика позволяет банкам:

Начинать с наиболее значимых областей – модулей обработки платежей, кредитования или интеграции платежных шлюзов.

Локализовать проблемы в одном модуле, не подвергая риску всю систему – базовый принцип корпоративной кастомной разработки.

Демонстрировать ценность постоянно – каждый обновленный компонент приносит мгновенную пользу, наращивая бизнес-эффект и ROI.

Реализация модульной архитектуры банка

1. Идентификация и разделение доменов

Процесс начинается с анализа монолитного ядра и выделения логических бизнес‑доменов: «онбординг клиентов», «кредиты», «карты». С применением микросервисов в банкинге и API-ориентированной архитектуры эти домены постепенно выносятся в независимые масштабируемые сервисы.

В Intelexity мы применяем domain‑driven design — ключевую практику современной объектно‑ориентированной инженерии, обеспечивающую плавный и управляемый переход.

2. Создание современной платежной основы.

Платежи – идеальный кандидат для первой модульной трансформации. Внедрение системы нового поколения открывает быстрые транзакции, интеграции с международными шлюзами и повышает понятность, пока прежнее ядро выполняет остальные функции.

Современные платформы оркестрации платежей обеспечивают бесшовную интеграцию с мерчант-сервисами, ACH‑платежами и новыми моделями как «купи сейчас – плати потом» (Buy-now-Pay-Later, BNPL) от провайдеров наподобие Klarna и Affirm. Наши решения поддерживают интеграцию с основными шлюзами – Stripe, PayPal – и региональными решениями, например Razorpay, CCAvenue и др.

Глобальный переход к стандарту ISO 20022 открывает новые возможности модернизации. По данным SWIFT, этот открытый стандарт обеспечивает более богатые и структурированные данные, повышая эффективность, прозрачность и совместимость во всем финансовом секторе.

3. Оркестрация через API‑слой.

API‑прослойка играет роль центральной нервной системы модульного ядра, направляя трафик между микросервисами и старой системой. Это создаёт единый интерфейс для внутренних каналов и внешних партнёров. Такой подход поддерживает как виртуальные терминалы, так и мобильные платежи.

4. Пошаговое выведение легаси‑систем.

По мере внедрения новых модулей доля классического ядра сокращается. Некритичные функции могут переходить на стандартные SaaS‑решения, а банк сохраняет контроль над ключевыми конкурентными преимуществами.

Это эволюция от каскадных (waterfall) моделей разработки к гибким (agile), основанным на управляемом, проверенном изменении.

Преимущества модульного банковского ядра

Гибкость и скорость. Запуск новых продуктов, например сервиса «купи сейчас – плати потом» (BNPL) или e‑commerce‑платежного шлюза – через разработку отдельных модулей, без изменений всего ядра. Микросервисы ускоряют вывод через SaaS-разработку.

Предсказуемый бюджет. Средства распределяются по сфокусированным проектам с понятным ROI, без гигантских авансовых инвестиций, характерных для тотальных переделок.

Минимизация рисков. Сбои локализуются: проблема в модуле кредитования не повлияет на депозиты или эквайринг.

Готовность к будущему. Подключение технологий нового поколения реализуется как plug‑and‑play – от блокчейн‑расчетов до ИИ‑обнаружения мошенничества.

Непрерывная трансформация облегчает внедрение инноваций, включая IoT‑ и встроенные решения.

В Intelexity мы реализуем эти преимущества через проверенные методологии миграции и архитектурное управление, превращая модульные принципы в измеримые бизнес‑результаты.

Соблюдение регуляторных требований на всех этапах работы

Модернизация банковских систем требует строгого соблюдения норм регуляторов. Мы внедряем механизмы соответствия BSA/AML, решения KYC, протоколы по борьбе с отмыванием средств и мошенничеством с самого начала.

Наша архитектура соответствует PCI DSS – глобальному стандарту безопасности для защиты данных держателей карт, а также требованиям SOX и других регуляторных норм.

Команды QA‑инженеров обеспечивают тестирование безопасности приложений, сетей, облака и защиты данных. Контроль доступа и управление привилегиями встроены в архитектуру каждого модуля.

Поддержка множественных платёжных шлюзов

Современные банки нуждаются в бесшовной интеграции с разными провайдерами платежей. Наш модульный подход обеспечивает поддержку:

Глобальных решений: Stripe API, Braintree, PayPal и другими международными процессорами.

Торговых сервисов: открытие мерчант‑аккаунтов, кредитную обработку и высокорисковые транзакции.

Альтернативных способов оплаты: интеграции с сервисами pay‑later, link‑платежами и виртуальными терминалами.

Заключение

Эпоха полной замены банковского ядра прошла. Модульное модель ядра банков позволяет эволюционировать постепенно, сохранять инвестиции и ускорять инновации.

В Intelexity мы сопровождаем этот переход, используя экспертизу в domain‑driven design, разработке микросервисов и модернизации традиционных банковских платформ. Как ведущая финтех‑компания, мы объединяем: точность разработки для индустрии здравоохранения – с надежностью решений в сфере автомобильной инженерии.

Мы помогаем вам строить ваше будущее – модуль за модулем.

Intelexity предлагает аутсорс‑команды и стратегические консультации для кастомных банковских решений – от трансформации устаревших систем до облачных решений. Наш опыт охватывает веб‑, мобильную и десктоп‑разработку как для стартапов, так и для корпоративных клиентов.

От архитектуры до DevOps и QA – каждый шаг направлен на стабильность, соответствие требованиям и измеримое конкурентное преимущество. Команды по безопасности гарантируют полное соответствие отраслевым стандартам.