Crypto Loans MVP

The client received a fully functional MVP, that demonstrates the entire lending lifecycle - from wallet connection to smart-contract-backed loan issuance. It is now used in demo sessions with potential partners, investors and regulators, while being ready for scaling into a full product.

BNPLFintechMobileBankingCreditScoringAPI Integration

Development Duration

3 Months

- Business Analyst

- PM

- Architect

- Back Developer

- Front Developer

- QA

- DevOps

- UI/UX Design

Technology Stack

Task

- Creation of a crypto-backed lending MVP: Develop a minimum viable product as the foundation for a large-scale financial platform.

- Full loan cycle: Implement the process from user onboarding to secure loan issuance and repayment, powered by smart contracts and integrated with popular crypto wallets.

- User experience and reliability: Deliver a seamless interface, combined with high technical resilience and scalability.

- Core MVP functionality: Real-time collateral valuation, automated risk mitigation mechanisms and a modular KYC structure for future AML/CFT compliance.

- Investor transparency and scalability: Build clear dashboards and a cloud-based architecture to support scaling and demonstrations.

What was done

- Development of smart contracts for lending: Created contracts that allow users to lock cryptocurrency (e.g., ETH) as collateral and set loan parameters: amount, term and LTV ratio - with automatic execution on the blockchain.

- Creation of a modern web interface: Implemented features for loan calculation, application submission and status tracking. Integration with Web3 wallets (MetaMask) ensures secure interaction.

- Integration of real-time price oracles: Enabled monitoring of collateral asset values with automatic liquidation triggered at critical thresholds.

- Onboarding with KYC integration: Built a flexible user onboarding process with integration points for third-party KYC providers to ensure future AML/CFT compliance.

- Deployment of cloud-based backend: Provided scalable processing of smart contract events, transaction monitoring and analytics.

- Creation of a demo video presentation: Produced a professional video showcasing the full process: from wallet connection and loan setup to automatic execution and repayment tracking.

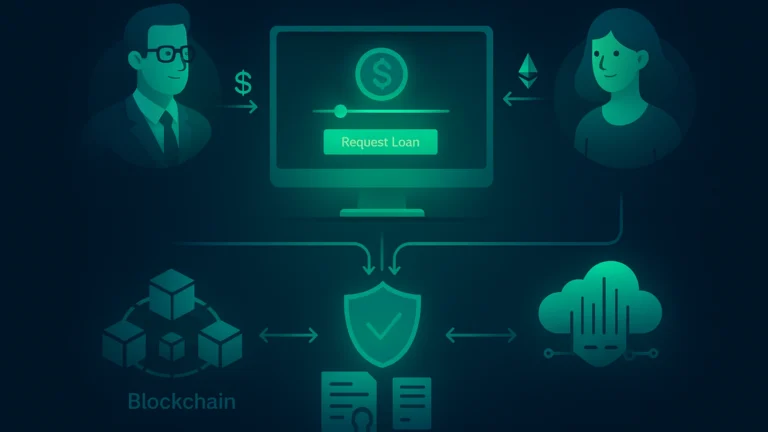

How it works

- For users: They connect a crypto wallet, calculate available loan amounts, based on their ETH balance and lock collateral via smart contracts. Funds are disbursed to the wallet after validation and repayment terms are displayed with automatic liquidation protection alerts.

- For the platform: Admins can monitor active loans, track collateral health, manage liquidity pools and export data for investor demos or regulatory checks.