Modular core banking transormation is reshaping how financial institutions approach IT modernization. It focuses on modernizing the software foundation of core banking systems by decomposing tightly coupled monolithic cores into independently deployable functional modules.

In this context, modularity refers strictly to software architecture and core banking platforms, not to hardware infrastructure, processors, storage systems or physical IT components.

For years the specter of a "core system replacement" has loomed over banking IT. The idea of ripping out and replacing a legacy core of banking software is a high-risk, high-cost myth, that often ends in delays, budget overruns and operational paralysis.

The future of banking is not a single painful event: it's modular. Piece by piece, banks can rebuild agility and modernize their architecture without the immense risk of a full-scale overhaul.

Why Legacy Core Banking Replacement is Impractical

It's common knowledge, that legacy cores are deeply woven into every banking process. A full replacement is like performing open-heart surgery on a marathon runner mid-race. According to

McKinsey, approximately 70 percent of banks are reviewing their core banking platforms due to concerns about limitations and slow pace of change. The challenges are simply prohibitive:

- Prolonged Business Disruption: Multi-year projects, that drain resources from innovation and daily operations.

- Escalating Budgets: Costs spiral with unforeseen complexities and integration hurdles.

- Significant Failure Rate: Many monolithic replacement initiatives fail to achieve their core objectives.

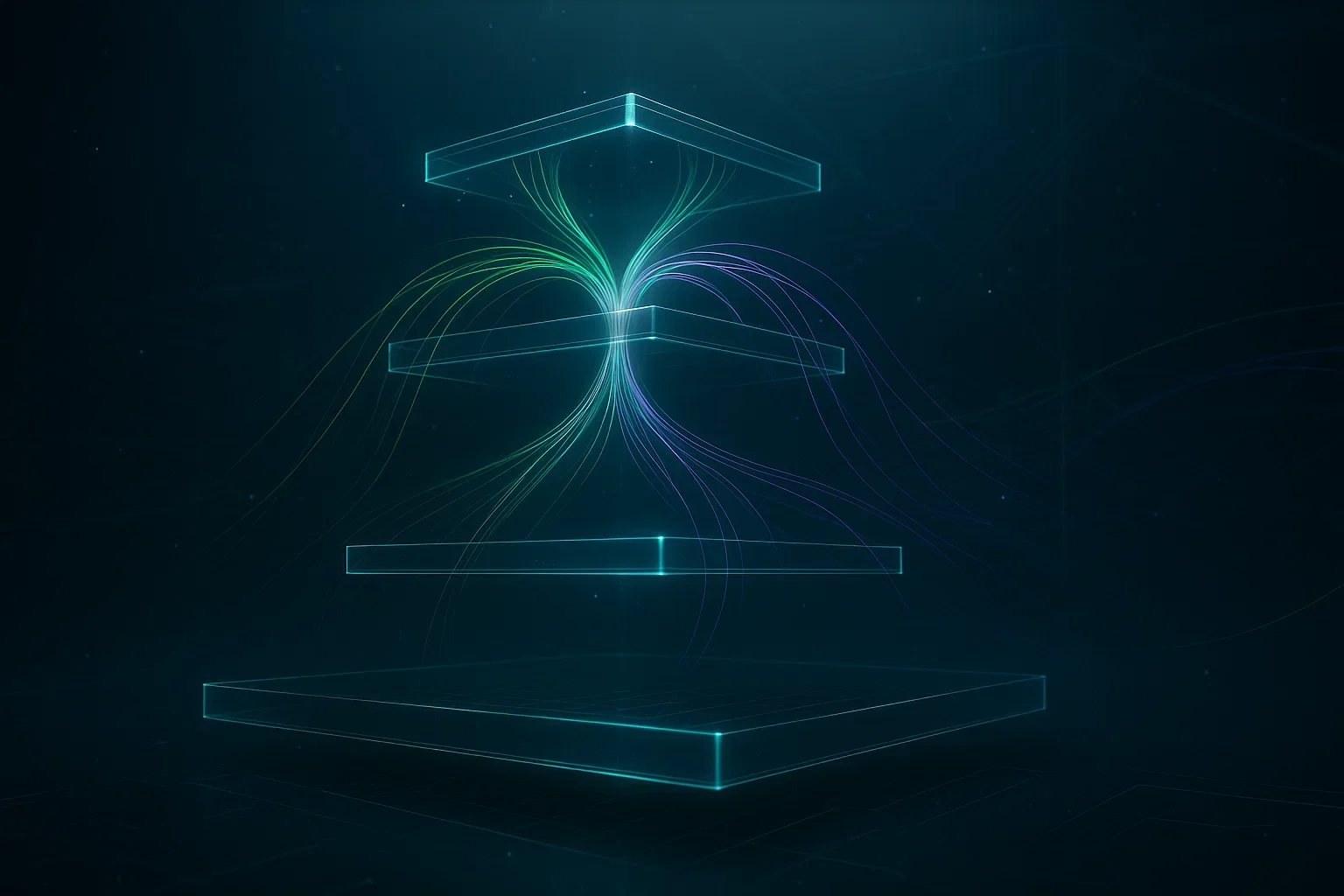

The Strategic Shift to Modular Core Banking

This approach strategically decouples and upgrades a bank's architecture one business domain at a time. Instead of installing a new engine, banks

upgrade individual components, like the transmission or electronics-sequentially.

This iterative SDLC approach aligns with modern agile programming principles, used in fintech software development. As highlighted by McKinsey's research on AI-driven banking, institutions that modernize core technology should organize their transformation around six crucial demands: technology strategy, superior experiences, scalable data platforms, hybrid infrastructure, configurable product processors and cybersecurity strategy.

This framework enables financial institutions to:

- Start with High-Impact Areas: Launch the journey with a critical domain like payment processing, credit card payment gateway integration or lending modules.

- Contain Risk: Isolate any issues to a single module without endangering the entire operation-a core principle of enterprise custom software development.

- Demonstrate Continuous Value: Each modernized component delivers immediate business benefits, building momentum and ROI.

Implementing Modular Core Banking Architecture

1. Identifying and Decoupling Domains

The process begins by analyzing the monolithic core to define logical business units like

"customer onboarding",

"loans" or

"cards". Using

microservices in banking and API-led architecture, these domains are gradually separated into independent scalable services.

At Intelexity we apply domain-driven design - a cornerstone of modern object-oriented software engineering - to create pragmatic and effective decoupling strategies for banks. Our custom software company expertise ensures seamless transition from legacy to modern architecture.

2. Building a Modern Payments Spine

Payments are a prime candidate for initial modularization. Implementing a next-gen

payment processing system allows banks to offer faster transactions, integrate with

international payment gateways and enhance transparency-all while the legacy core manages other functions.

Modern payment orchestration platforms enable seamless integration with

merchant services, ACH payment processing and emerging solutions like

Buy-now-Pay-Later (BNPL) services from providers such as Klarna and Affirm.

- Our payment integration services support connections to major gateways including: Stripe, PayPal payment gateways and regional solutions like Razorpay and CCAvenue.

The global transition to ISO 20022 messaging standard creates additional opportunities for modernization. According to SWIFT, this open global standard provides richer, more structured data that enhances efficiency, transparency, and interoperability across the financial industry.

3. Orchestrating with an API Layer

A robust API layer acts as the central nervous system for the modular banking sodtware core. It seamlessly routes traffic between new microservices and the legacy system, creating a unified interface for internal channels and external partners. This

payment gateway integration approach supports both

virtual terminal payments and

mobile payment processing.

4. Incremental Decommissioning

As new modules mature, the traditional core's footprint shrinks. Standard SaaS solutions replace non-critical functions, while the bank retains full control over its competitive differentiators.

This waterfall software development to agile transition follows proven software project management methodologies.

Advantages of Modular Core Banking

- Agility and Speed: Launch new products such as a BNPL service or e-commerce payment gateway by developing single modules rather than modifying the entire core. With microservices in banking new products go live faster through SaaS application development.

- Predictable Budgeting: Allocate funds to specific, value-driven projects with clear ROI, avoiding massive upfront investment typical of custom application development overhauls.

- Mitigated Risk: Confine potential failures. A problem in a new lending module doesn't affect the deposit-taking system or merchant payment processing capabilities.

- Future-Proofing: Simplify adoption of next-generation technologies by integrating them as plug-and-play services-from blockchain settlement to AI-powered fraud detection.

Incremental banking transformation allows seamless adoption of innovative IoT software development and embedded software solutions.

At

Intelexity we ensure these advantages are realized through proven migration methodologies and architecture governance, turning modular principles into improved business outcomes.

Ensuring Regulatory Compliance Throughout Transformation

Banking modernization must maintain strict adherence to

regulatory compliance requirements. Our approach integrates

BSA/AML compliance,

KYC software solutions and

anti-money laundering protocols at every stage.

We ensure your modular architecture meets PCI DSS requirements-the global security standard administered by the Payment Card Industry Security Standards Council for protecting cardholder data. Our solutions also comply with SOX and legal regulatory compliance standards.

Our QA software engineer teams implement rigorous testing for

application security, network security, cloud security and data privacy requirements. Access management and privileged access management are built into every module from the ground up.

Comprehensive Payment Gateway Support

Modern banking requires seamless integration with diverse

payment gateway providers. Our modular approach development supports:

- Global Payment Solutions: Integration with Stripe API, Braintree payment, PayPal checkout and other global payment processors

- Merchant Services: Full merchant account services, merchant credit card processing and high-risk payment processing capabilities.

- Alternative Payments: Integration with pay-later apps, link payment solutions and virtual credit card terminal systems.

Conclusion

The era of complete core replacement is over. Modular core banking platform allows banks to evolve gradually, protect existing investments and innovate with speed.

At

Intelexity we guide this evolution with expertise in domain-driven design, custom microservices development and traditional banking platforms modernization. As a leading fintech software development company, we combine healthcare software development precision with automotive software engineering reliability.

We help you construct your future, one module at a time.

Intelexity provides outsourced

fintech teams and strategic consulting to create tailored banking solutions-from

legacy system transformation to

cloud-native solution development. Our software development for startups and enterprise clients spans

custom web software development, custom mobile application development and desktop application development.From initial architecture to DevOps and QA, we ensure each step delivers stability, compliance and a tangible competitive advantage. Our security and operations consulting teams guarantee your transformation meets the highest industry compliance regulations.

Book a session with our architects to identify your first modular use case and develop a realistic high-impact transformation plan.